The price of Curve Finance’s governance token CRV spiked by more than 100 percent as the decentralized exchange (DEX) experienced a massive surge in trade volume.

Earnings

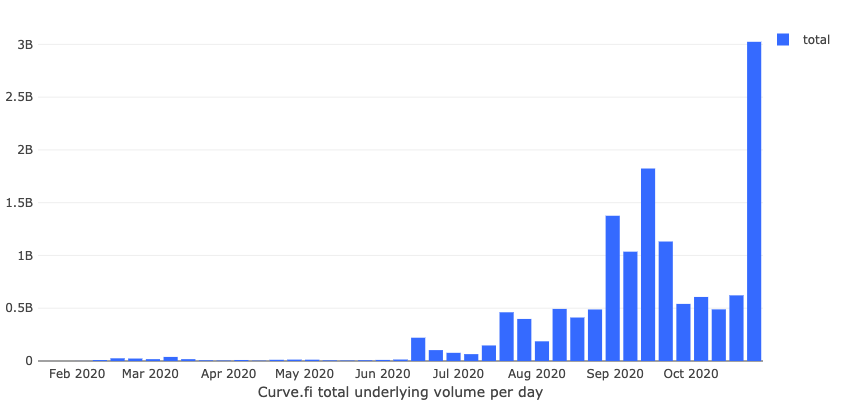

Curve Finance processed about $2.8 billion worth of trades on Monday, almost 450 percent higher than its previous record high in September 2020. The jump in its trade volume coincided with a similar spike in the UniSwap decentralized exchange – of about $2 billion.

Curve.fi total underlying volume. Source: Dune Analytics

Together, the DEX platforms reported a $5.8 billion in total volume on Monday. Nevertheless, the reason why their daily trade activities rose to a record high was a hack at Harvest Finance, a liquidity pool that lost about $25 million to a flash loan exploit.

Researchers found that both Curve and UniSwap enabled the hacker to purchase, sell, and swap borrowed USDC and USDT tokens automatically by offering their liquidity pools. They, in turn, earned higher trading fees, with the Curve pool adding about $1.14 billion in CRV fee reserves on Monday alone.

CRV Pumps

The earnings partially explain why the CRV/USD exchange rate rose by 61 percent on Monday as it established a multi-week high at $0.689. Meanwhile, the rally came as a part of a modest retracement that started earlier on Sunday. That, overall, brought the CRV/USD’s gains up by 108 percent.

The Curve Finance token showed signs of downside correction after its 100% rally. Source: CRVUSD on TradingView.com

The Curve Finance token showed signs of downside correction after its 100% rally. Source: CRVUSD on TradingView.com

Nevertheless, the latest rebound also came as a part of a broader downtrend. At its all-time high, CRV/USD was changing hands for as much as $25.17. But as soon as the hype surrounding the DeFi space faded, the pair started correcting lower from its overbought region.

It eventually crashed to 0.327 on October 25, 2020, down 98.7 percent from its record peak. The Curve Finance’s latest bounce also came as a signal of bottoming out, so says a list of prominent traders.

“CRV up 45%. Perfect kind of setup and play with risk to reward,” said a pseudonymous analyst. “The only bad part is that I didn’t take this trade.”

He forecasted that the CRV/USD and CRV/BTC would rise by as much as 10 times their current rates.

The $CRV trade I shared in the newsletter is already up a cool 40%.

— The Wolf Of All Streets (@scottmelker) October 28, 2020

Nevertheless, CRV was already showing signs of correcting lower as its price fell 17.88 percent during the Wednesday trading session. So it appeared, the jury is still out on whether or not the token could reclaim its record high.

“Genuinely VERY weird to see it not dump for a day,” said market analyst Teddy Cleps. “I’m in full disbelief.”