The Bitcoin market tumbled in the early hours of today, and some people were even worried that the top coin could plunge further into the $8k range if the dynamics don’t adjust soon enough.

Pundits are gazing into the market data to find possible triggers of the fresh dip in just a few weeks after the halving that was for long expected to swing the price upwards.

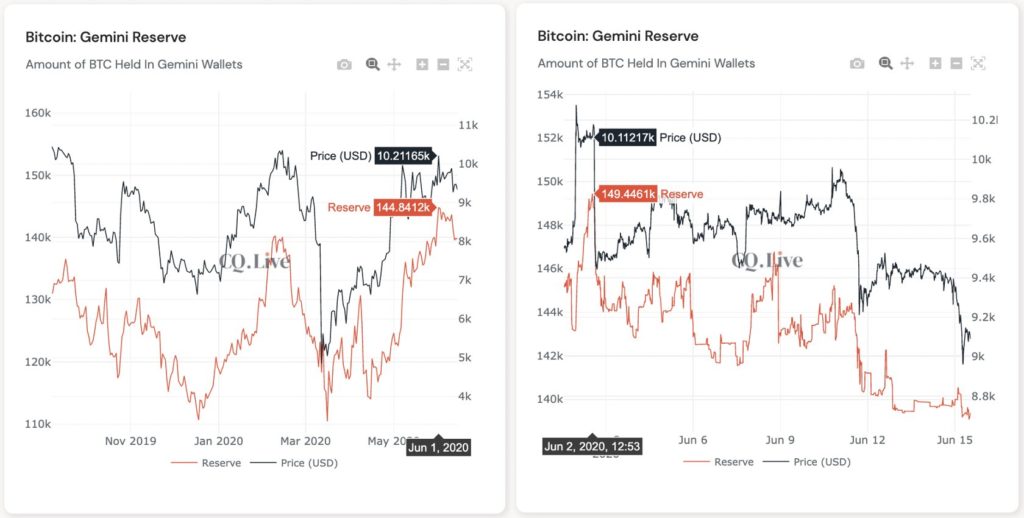

Two people, Mason Jang and Ki-Young Ju have made efforts to identify the core genesis of the price dip. They both work for On-chain data/chart provider CryptoQuant, with Young as the CEO and Mason as the CSO. According to them, there was significant whale activity on two exchanges, Gemini and Coinbase, right before Bitcoin’s price took a dive.

Whales Control The Price

According to Young, Bitcoin’s price is controlled by whales that hold significant stashes and whose sudden moves affect the market on a large scale.

Chart By CryptoQuant

Chart By CryptoQuant

While sharing a chart tracking Gemini’s exchange activity at the time of the dip, Young said that at a certain level as whales pulled out and decreased the BTC reserves, the exchange indicated that the crypto had just entered a bear market.

Apparently, whales transferred around 144,000 BTC from the exchange, and that’s a pretty huge amount for a cryptocurrency that has just 21 million coins limit.

Keep An Eye On The Fast Movers

It’s not the first time that whale activity has affected Bitcoin’s price either upwards or downwards. On his part, Mason’s post noted that Bitcoin’s price started dipping as US stocks tumbled.

Chart By CryptoQuant

Chart By CryptoQuant

Chart By CryptoQuant

Chart By CryptoQuant

However, the whale activity on Gemini and Coinbase happened before the crash, making them the main gainers since they positioned themselves to pull out early and then buy on the dip.