As revealed by the Bitcoin stock-to-flow creator, ‘Plan B’ in a recent tweet, there are more than 200,000 ultra-high-net-worth individuals (UHNWI) in the world. These individuals’ net worth isn’t lesser than $30 million. Their investment would, therefore, be instrumental should they decide to get into the crypto space.

Protecting Wealth From Inflation

According to his tweet, this isn’t a new topic to be discussed on the platform, and if these ultra-high-net-worth individuals buy bitcoin they will buy more than 2 BTC. Therefore, the question is what would happen if just 10% of these individuals invest their money in BTC.

A community member stated that in the coming recession, investors will look for safe havens to store their wealth as banks and third-party agents cannot be trusted. The pandemic has threatened economies and led to more financing from governments as well as a decrease in the flow of income for businesses.

The expected slowdown from these effects might push ultra-high-net-worth individuals to seek other more reliable avenues to put their wealth to protect it from inflation. One of these safe avenues is Bitcoin.

Plan B asserted that the reason this hasn’t happened so far, even after the 2017 surge in price is that mainstream media like Bloomberg, WSJ, and Ft are still spreading false narratives about BTC. According to their narrative, BTC is for criminals and governments will ban it. This anti-bitcoin narrative has been effective as many of these UHNWI and more people that are influential are yet to have a look at BTC.

Effect Of UHNWI Investing In BTC

If only 10% of the world’s high worth individuals invested in BTC, the effects would be felt not only on BTC but also on multiple other cryptocurrencies. The action would cause speculative trading, as well as act as a marketing tool for BTC whereby many advocates, enthusiasts, and critics of these millionaires would rush to be part of BTC.

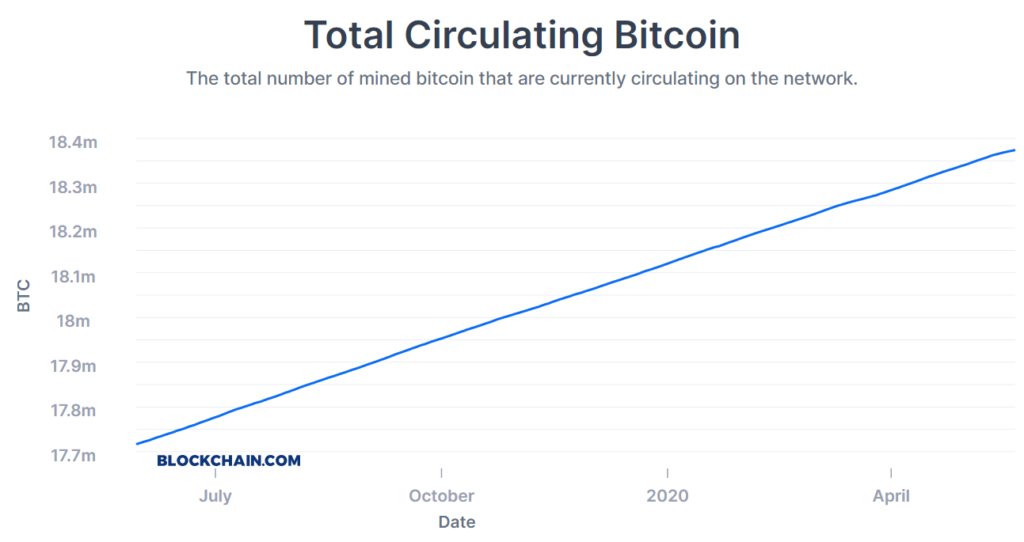

Total Circulating Bitcoin Chart – Source: Blockchain.com

Total Circulating Bitcoin Chart – Source: Blockchain.com

The FOMO created by such a move would cause the price of BTC to increase drastically, most likely tripling its all-time high price of $20k experienced in 2017 as 10% of their cumulative portfolio would be averagely capped at $2.5 Trillion.

Additionally, it could lead to a change of opinions from some of the anti-bitcoin groups, making way for detractors to also be interested in BTC. A reduction in the number of these anti-bitcoin campaigns can positively affect bitcoin’s popularity, hence boosting its adoption.