Ethereum and the entire crypto market have been battered by Bitcoin’s weakness, with the benchmark cryptocurrency’s decline creating headwinds that have caused most digital assets to post serious losses.

Some believe that this recent downtrend has marked an end to the bull run that many digital assets have been seeing as of late, with tokens within the Ethereum-based DeFi sector being particularly hard hit by this recent downturn.

That being said, one analyst is noting that there are some signs that the market – and the DeFi sector in particular – is bottoming.

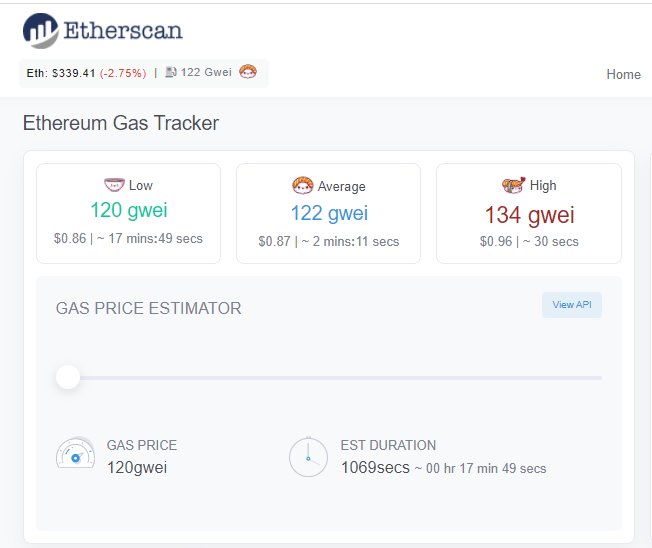

He is pointing to incredibly low gas fees as one reason why the crypto could be in for some upside in the days and weeks ahead.

Because low gas fees signal that demand for Ethereum blockspace is also low, the analyst concludes that this signals that DeFi investors are holding strong and not offloading their holdings just yet.

Ethereum and DeFi Sector Hit Hard by Recent Bitcoin Selloff

Bitcoin has been sending shockwaves throughout the entire crypto market throughout the past few days and weeks, with the cryptocurrency’s decline from highs of $12,400 to lows of $9,900 striking a blow to its uptrend.

This weakness has spooked investors and created a headwind for small digital assets.

Ethereum has been particularly impacted by this, with the crypto’s price plunging all the way down to lows of $320 from weekly highs of $490.

This decline struck a heavy blow to the DeFi sector, with many previously bullish tokens losing a significant amount of their momentum.

As yields on different DeFi incentives begin waning, it remains a strong possibility that the hype surrounding this sector begins waning – at least in the short-term.

Low ETH Gas Fees Suggest the Bottom May Be Nearing

Despite the recent weakness seen by Ethereum and DeFi tokens, one prominent analyst believes that low gas fees suggest that the bottom may be nearing.

The analyst explained that the lack of demand for the Ethereum network at the present moment signals that investors are holding onto their tokens, which means all the sellers may have already been flushed out.

“Gas fees have remained relatively low despite the dump that happened during the last hour. I assume the lack of network activity implies that most token holders, ETH and DeFi tokens alike are HODL-ing. I guess that we must be close to the bottom if we’re not already there,” he noted.

Image Courtesy of Theta Seek.

Bitcoin’s price action will likely continue guiding that of Ethereum and the DeFi sector. If it is able to continue defending $10,000, there’s a chance that further upside is imminent.

Featured image from Unsplash. Pricing data from TradingView.