Bitcoin buyers seem to have returned after three months of inactivity. Just hours ago as of this article’s writing, the leading cryptocurrency inched above $10,300 for the first time since the early June highs. Holders of BTC were euphoric, to say the least.

Although there are many reasons to believe Bitcoin has room to rally, data indicates whales are selling the rally. If that has an impact on the price of BTC remains to be seen, especially due to the ongoing “FOMO.”

Related Reading: Crypto Tidbits: Twitter’s “BTC Scam,” Elon Musk & Dogecoin, Institutions Want BTC & ETH

Crypto Quant CEO: Bitcoin Whales May Be Selling the Rally

Crypto Quant chief executive Ki Young Ju shared in the wake of the rally past $9,300 that Bitcoin may be moving up too fast.

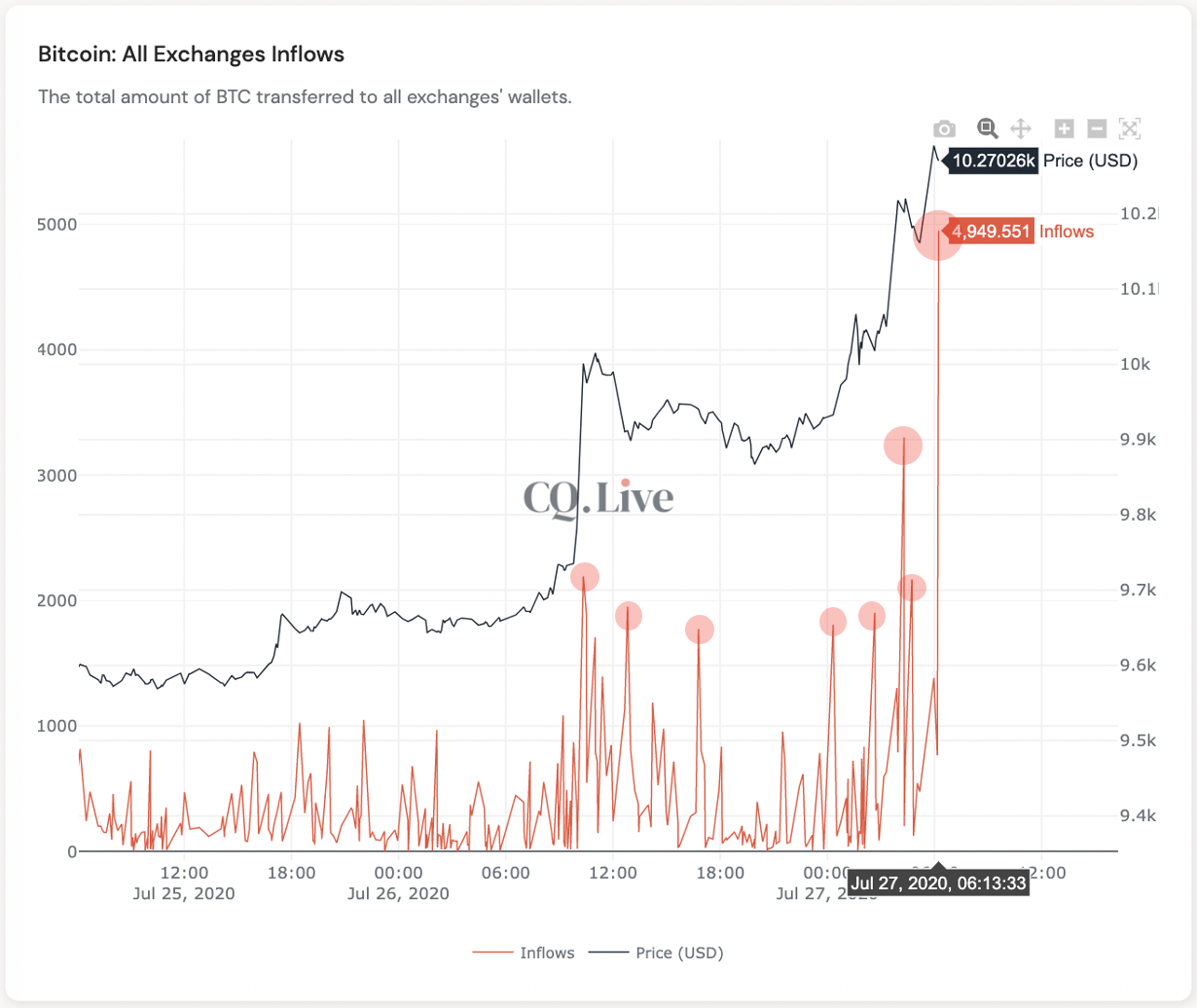

He shared the chart below from his company, an on-chain analytics firm. It shows the number of BTC sent to wallets affiliated with exchanges, which is coupled with Bitcoin’s price action.

Ki Young Ju wrote in regards to the chart: “BTC price went up too fast. Seems like other whales think so too.”

Chart from Ki Young Ju, the CEO of Crypto Quant, a crypto data platform. Chart is of BTC exchange inflows over recent days.

According to the data, Bitcoin investors (likely “whale” holders) sent 5,000 BTC to exchanges in the span of an hour as price spiked to $10,300. This adds to the tens of thousands of coins sent to exchanges over recent days.

It is unclear what happened to the coins deposited into exchanges. But the on-chain analyst is insinuating that the coins were sent to the exchange to be sold for fiat or altcoins.

Reasons to Be Bearish on BTC

There are a number of reasons to be bearish on Bitcoin from a technical perspective.

The most notable, analysts say, is that BTC has formed what is known as a “CME gap.”

BTC trades on the world-famous derivatives exchange the CME, though its contracts do not change hands on the weekend. This means that if Bitcoin moves strongly on the weekends, it can form a “gap,” where CME contracts do not trade.

The recent rally has allowed Bitcoin to form a $300 gap between ~$9,600 and $9,900. This is pertinent to price action as data from Markets Science, a crypto research firm, indicates that 77% of gaps fill in the week after they are formed.

There is also the Tom Demark Sequential (TD Sequential), which has formed a textbook sell signal on the Bitcoin chart. The indicator is known for printing “9” and “13” candles at inflection points in the trend of an asset.

Related Reading: On-Chain Metric Signals the BTC Market Isn’t Overheated: Why This Is Bullish

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com On-Chain Data: BTC Whales Are Selling the Explosion Past $10,000