Despite stagnation in the value of ETH, demand for Ethereum transactions continues to increase day after day. This is largely due to the growth seen in what is known as decentralized finance — or “DeFi.” Coins and protocols pertaining to this space are largely based on Ethereum, meaning that the network has racked up countless transactions attempting to satisfy DeFi users.

According to Etherscan data, transaction fees are reaching highs not seen since the summer of 2015.

This indicates to developers that solutions are needed, or else users seeking low-cost transactions and smart contract interactions will be squeezed out.

Related Reading: “Rich Dad Poor Dad” Author: Bitcoin Could Soon Become the “Fastest Horse”

Ethereum Transactions Fees Are Spiking Once Again

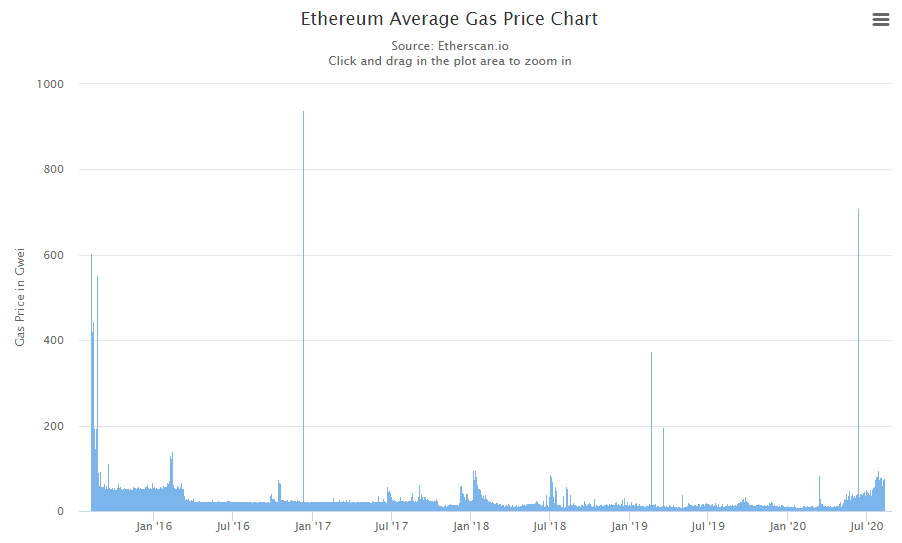

Ethereum transaction fees are reaching highs not seen since the summer of 2015, according to data shared by economist Alex Krüger. He posted the graph seen below on August 10th, showing that the average “gas” one is paying for Ethereum transactions is the highest it has been since mid-late 2015:

“High demand is driving Ethereum gas prices up. The 30 day average gas price has recently reached levels only seen in the summer of 2015, right after Ethereum launched.”

Chart of the average gas cost (Gwei) of Ethereum transactions from Etherscan, shared by Alex Kruger, a cryptocurrency analyst and economist.

Related Reading: Crypto Tidbits: Bitcoin Explodes Past $11k, Ethereum 2.0 Nears, Cardano’s Shelley Launches

A Fix Is Needed

Analysts say that a fix is needed for Ethereum’s transaction fee issue. Otherwise, other smart contract focused blockchains such as Tezos or Cardano are expected to chip away at the market share that the network has carved out for itself. As Qiao Wang, a former head of product at Messari, once explained:

“I’ve changed my mind after using a dozen of Defi platforms. So long as ETH 2.0 is not fully rolled out, there’s an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX.”

I've changed my mind after using a dozen of Defi platforms. So long as ETH 2.0 is not fully rolled out, there's an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX. https://t.co/vXAAFET3YK

— Qiao Wang (@QWQiao) June 28, 2020

Fortunately, it appears that solutions to Ethereum’s transaction fee issues are on their way.

The final public testnet for Ethereum’s 2.0 upgrade (ETH2) just launched last week. Dubbed “Medalla,” the testnet is believed to indicate that the launch of the ETH2 upgrade is just a month or two away.

ETH2 will implement Proof of Stake (staking) and sharding, two technical processes that in tandem should work together to dramatically increase the efficiency of the blockchain. The upgrade will be fully rolled out within the next two or so years, some developers say.

In the shorter-term, second-layer scaling solutions such as “roll-ups” are being adopted to increase the speed and decrease the cost of Ethereum transactions.

Related Reading: How U.S. Restrictions on Wechat & Other Chinese Brands Could Boost Crypto

Featured Image from Shutterstock Price tags: Charts from TradingView.com Ethereum Transaction Fees Are Reaching Highs Not Seen Since 2015