Research firm Santiment has determined that Ethereum’s supply radius on exchange platforms is at a 28-month low. With 20.1% of ETH in its reserves, the last time the metric was at similar levels was in November 2018.

Source: Santiment

Source: Santiment

Above is a look at the relationship between the increase in Ethereum supply on the exchanges and fluctuations in its price. ETH’s rally in recent months corresponds to a sustained decline in this metric.

Ethereum is trading at $1,808 with bearish performance in the 24-hour chart. However, in the last hour ETH is showing an uptrend with 0.3% gains, after a week of negative performance. If the cryptocurrency manages to stay above the current level it could gain more momentum and go after resistance at $1,850.

Ethereum breaking above $1,800. Source: ETHUSD Tradingview

Ethereum breaking above $1,800. Source: ETHUSD Tradingview

Where is Ethereum’s demand coming from?

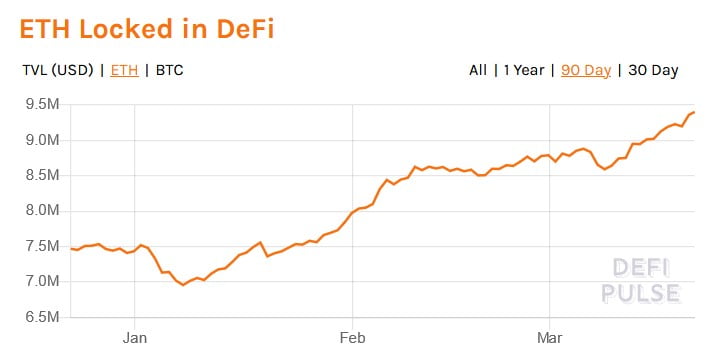

Two sectors are currently taking a big part of ETH’s supply. Data from DeFi Pulse register 9,4 million ETH locked in DeFi protocols. After registering a drop at the end of February, ETH inflows into decentralized finance protocols have absorbed 1.5 million ETH since March 8.

This trend is continuing and shows no signs of weakening, as more and more users join the sector for profits or to participate in the Non-Fungible Token (NFT) craze.

Source: DeFi Pulse

Source: DeFi Pulse

MakerDAO, Compound y Sushiswap hold the biggest amount of ETH with 3 million and 1.4 million each, respectively. Uniswap, Aave, Alpha Homora, and Balancer follow, but only the decentralized exchange (DEX) holds over 1 million ETH.

On the other hand, Ethereum 2.0 deposit contract has also absorbed a lot of ETH supply. At the moment, it holds 3,559,362 ETH with an estimated value of $6 billion. According to Arcane Research, more institutional demand has come for ETH since late 2020:

the steady increase in ETH loans outstanding. After ending Q1 at 5.5%, the share of ETH loans outstanding grew 177% over the next three quarters, ending the year at 15.5%. Of course, some of this growth is attributable to ETH’s price inflation.

Sustained demand for ETH could positively impact its price and allow the rally to continue through 2021. According to ETH Gas Station, transactions fees on the blockchain are again at record levels with 161 Gwei for the cheapest.