Cryptocurrencies, especially Bitcoin have received their fair share of attention this year, thanks to increasing interest in digital currencies among traditional financial institutions and the pandemic-driven economic slowdown affecting economies and markets. The research division of leading crypto spot and derivatives exchange OKEx – OKEx Insights in collaboration with blockchain data firm Catallact has recently concluded a comprehensive study of transactions conducted over the Bitcoin blockchain to identify the prevailing investment trends in the sector.

The study considered on-chain Bitcoin data from the month of January till the beginning of August, taking into account the transaction sizes to understand the behavior of large-scale investors in the sector. One of the aims of this study was to find out whether the inclusion of Bitcoin into the portfolios of well-known funds really drive institutional investors to invest in the flagship cryptocurrency as claimed or not.

There have been a number of instances in the recent past including macro investor Paul Tudor Jones’ announcement that his Tudor BVI fund will trade Bitcoin futures, and the story of Nasdaq-listed MicroStrategy acquiring bitcoins worth over $250 million to hedge against inflation, which has led people to believe that more and more large scale investors continue to hoard cryptocurrencies. In order to identify the behavior, the OKEx Insights- Catallact study differentiated Bitcoin blockchain data into 4 different categories based on the transaction size.

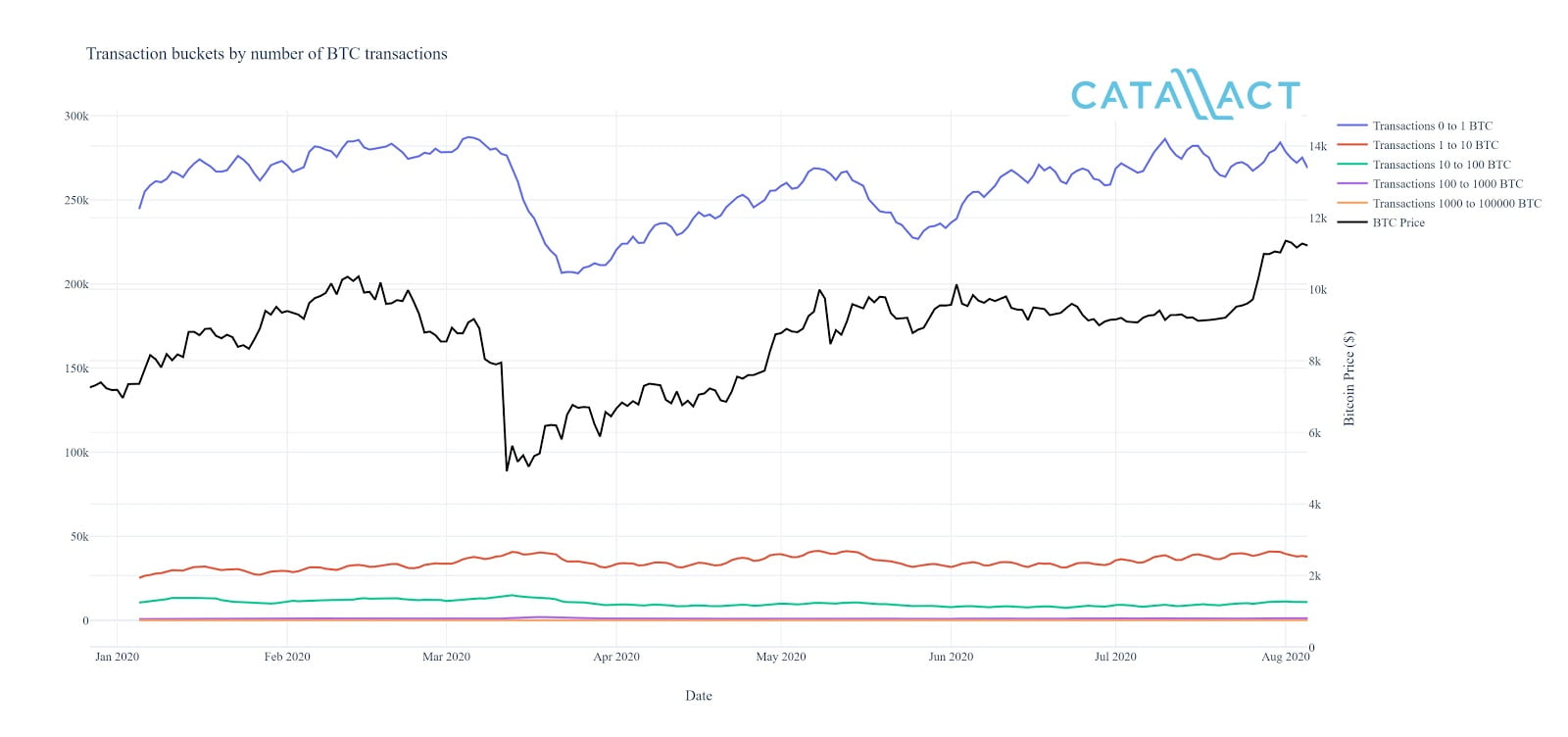

It was assumed that most of the daily transactions in the range of 0-1 BTC belonged mostly to retail investors, with a small percentage of it that can be attributed to payments by crypto users. The second category included medium-sized transactions of 10- 100 BTC per day, attributed to miners and bigger retail players, followed by large daily transactions of sizes ranging from 100 BTC to 1000 BTC by large investors. Finally, transactions over 1000 BTCs were assumed to be either made by exchanges or institutional investors.

The number of transactions decreases as the amount of BTC being transacted increases. Source: Catallact

A comparison of the number of such transactions against Bitcoin’s market price movement allowed the team to identify certain behavioral trends that were prevalent during the first half of this year. Smaller transactions of under 10 BTC made up for the greatest number of transactions on the blockchain, with a majority of them being less than 0.1 BTC. These transactions were found to closely track the cryptocurrency’s market price movement and decline whenever there is an increase in volatility or a decline in price.

Meanwhile, the medium-sized transaction volumes are more resilient in comparison to smaller transactions. Even when the market was under duress due to the worsening COVID19 situation, the deviation in trend was minimal except for the time around the Bitcoin halving event when the activity went down for a while. It is not surprising as the category includes miners. At the same time, large investors and crypto whales seem to have made up for the drop in transactions by carrying on business as usual following a quick recovery.

When it comes to larger volume transactions in the range upwards of 1000 BTC, the number of daily transactions witnessed repeated spikes throughout the price consolidation phase between May and July. Most of these transactions originated from crypto exchanges as they shuffle funds between wallets for security purposes, large institutional players and big-money whales as they accumulate or distribute crypto holdings in anticipation of price movements during the consolidation phase.

The study infers that institutional investors and crypto whales are more likely to buy into large amounts of crypto during the lean phase when the prices are at the lower end, as in this case. They prefer to buy into the market at a lower price and hold on for the long term with an expectation that Bitcoin value will increase over time to generate huge returns as compared to other conventional investment avenues.